The 4th list of Critical Raw Materials has been published by the European Commission at the beginning of September 2020 [1]. A trend of increased criticality is observed for all raw materials in 2020 compared to 2017: niobium, tantalum and tungsten, the target metals for the H2020-RIA-TARANTULA project, follow this trend too. The supply risk of tantalum increased, niobium has both a higher supply risk and a higher economic importance and tungsten is the raw material with the highest economic importance. Why? What changed, in detail, in the list? Read this article to know more.

The 4th list of Critical Raw Materials (CRM) has been published by the European Commission in the beginning of September 2020. The list includes a new element, strontium, and considers, compared to 2017, three materials as being critical: bauxite, lithium and titanium. In general, the criticality of all raw materials increased from 2017 to 2020 and this also happened for niobium, tantalum and tungsten.

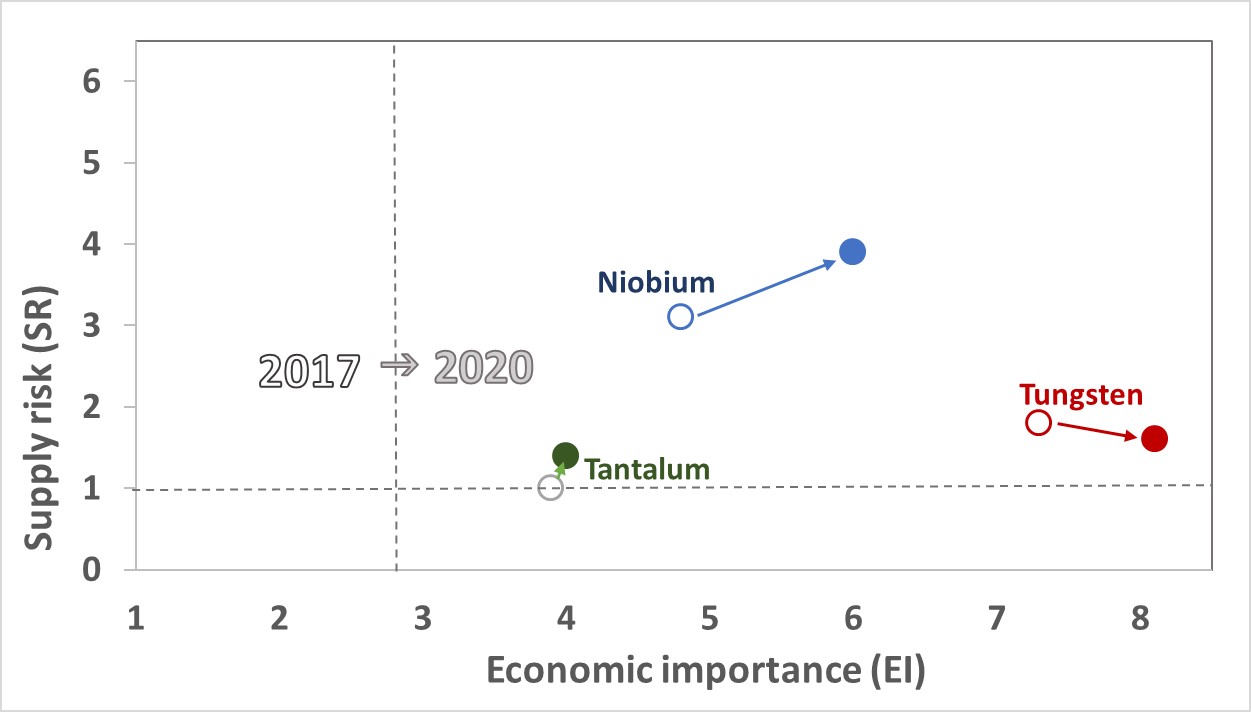

Criticality of raw materials is evaluated on the basis of their supply risk (SR) and economic importance (EI). The SR corresponds to the risk of supply disruption of a specific material; it is primarily based on the resources of a country and its import/export strength, but can also be affected by one-time unpredicted events such as the rare-earth crisis in 2011 or the COVID-19 pandemic.

The EI takes into account the importance of a given material in the EU for end-use applications and the performance of available substitutes in these applications. The criticality assessment results of 2020 are plotted in Figure 1.

.png)

Figure 1. Criticality assessment results (adapted from [1])

What about W, Nb and Ta?

What is new in the CRM 2020 list and especially for tungsten, niobium and tantalum? First of all, it has to be taken into account that the assessment methodology is revised in every list (i.e. 2020, 2017, 2014 and 2011) and looking to the specific numbers might be misleading.

For instance, the EI of tungsten increased from 2017 to 2020, i.e. from 7.3 to 8.1, but it also decreased compared to 2014 (9.1) and 2011 (8.8). Does this mean that the EI of tungsten is actually lower? Not exactly. Rather, the methodology to assess the EI has changed, thereby affecting the result.

Therefore, it is advised to analyse the results in terms of trends. Figure 2 depicts the changes in the positioning of niobium, tantalum and tungsten from 2017 (empty dots) to 2020 (full dots).

Figure 2. Changes in the positioning of niobium, tantalum and tungsten from 2017 (empty dots) to 2020 (full dots) (data from [1])

Tungsten

Tungsten is, in fact, still the metal with the highest EI (cf. also Figure 1) due to its application mainly in a strategic sector such as Defence and Space, where it is employed in digital technologies and 3D printing, but also in drones and in robotics.

Compared to 2017, tungsten has been estimated to have a higher value-added of NACE (French acronym for the Statistical Classification of Economy Activity in the European Union) sectors.

Contemporarily, the SR of tungsten decreased because the distribution of smelters worldwide was considered. Most importantly, the Import Reliance of this metal is negative, i.e. exports are higher than imports, and this is the main reason of the relatively low SR of tungsten. In fact, the JRC Foresight Study [2], which supported the compilation of the CRM 2020 list and which only analyses the SR, classifies tungsten in a light green, low-risk class.

Tantalum

Tantalum is also considered at low SR by the JRC study, although this SR increased in the last three years. The critical stage for tantalum is extraction, since it is mostly sourced in the Democratic Republic of Congo and in Rwanda, two countries with a very high World Governance Index (7.6 and 5.2, respectively).

On the other hand, the End-of-Life Recycling Input Rate for this metal is 0% (against the 42% of tungsten) and its EI is becoming higher and higher for its irreplaceable use in capacitors and in electro-optical systems and engines for the defence aeronautic applications.

Niobium

Niobium can be seen as the most interesting of the here-considered three metals, having a significant growth both in its SR and in its EI.

In fact, niobium has a primary role in high-strength stainless steel and super-alloys for most strategic technologies – i.e. in 3D printing, drones, wind turbines and robotics.

Niobium is also foreseen to be used in future anode and cathode materials for electric batteries. Electric batteries are the most crucial strategic technology since it serves also robotics, drones and digital technologies and it is relevant for all the strategic sectors considered by the EU, namely Renewables, E-Mobility, Defence and Space (see Figure 3).

In turn, also robotics and digital technologies are fundamental to other strategic technologies and all these interlinkages significantly affect the EI of the raw materials involved, such as niobium.

Figure 3. Strategic technologies and sectors for the EU economy and their interlinkages (taken from [2])

Conclusions

In conclusions, what can we learn from the EU CRM 2020 list? First of all, it is in fact a European list and what is critical for Europe might not be for other countries for three reasons:

- the SR is a very geopolitical factor, based on the natural resources of a country;

- the technology to process, and to recycle, a raw material also varies from country to country and it affects both the SR and the EI;

- the strategic technologies and the strategic sectors, at the basis of the JRC study, also vary through the globe. For instance, would tungsten still have such a high EI, if Europe wouldn’t consider Defence and Space as a strategic sector? Exactly, the strategic sectors and technologies had for the first time in 2020 a strategic (could we use another word?!) role for the study.

The interconnections between all of them, as well as their predicted growth, had particular relevance, as witnessed by the case of niobium. Another outcome of the CRM 2020 list is how quickly technologies change: in 2017, neither 3D printing nor drones were considered so fundamental for EU safety and sustainability.

This confirms the importance to have frequent, every three years, CRM reports. Hopefully, the new technologies will increment the End-of-Life Recycling Input Rate of the CRM such as of tantalum and niobium, for which it is currently 0%, while lowering the Import Reliance.

From our side, the H2020-RIA-TARANTULA project is deeply engaged to reduce the criticality of the refractory metals niobium, tantalum and tungsten by combining the development of new processing technologies with studies on the civil society engagement.

References

- European Commission, Study on the EU’s list of Critical Raw Materials (2020), Publications Office of the European Union, Luxembourg, 2020. https://doi.org/10.2873/398823, https://rmis.jrc.ec.europa.eu/uploads/CRM_2020_Report_Final.pdf.

- JRC, European Commission, Critical materials for strategic technologies and sectors in the EU – A foresight study, Publications Office of the European Union, Luxembourg, 2020. https://doi.org/10.2873/58081, https://rmis.jrc.ec.europa.eu/uploads/CRMs_for_Strategic_Technologies_and_Sectors_in_the_EU_2020.pdf.

TARANTULA

You can learn more about the H2020-RIA-TARANTULA work at: https://h2020-tarantula.eu/

Recent relevant article:

- https://kuleuven.sim2.be/why-tungsten-niobium-and-tantalum-are-critical-raw-materials/

- https://kuleuven.sim2.be/the-green-transition-challenged-by-the-metal-supply-chain/

Stay tuned with the SIM² newsletter (https://kuleuven.sim2.be/news/)!

Acknowledgements

The TARANTULA project received funding from the European Union's EU Framework Programme for Research and Innovation Horizon 2020, Grant Agreement no. 821159. This work reflects only the team views, exempting the Commission from any liability.